How to Save on Auto Insurance by Bundling Policies: A Comprehensive Guide

Exploring the world of bundling policies for auto insurance can lead to significant savings and added benefits. From understanding the concept to maximizing your savings, this guide will cover all you need to know about bundling policies for auto insurance.

When it comes to saving money on auto insurance, bundling policies is a smart and effective strategy that many may not be aware of. By combining different insurance policies, you can unlock discounts and streamline your coverage, ultimately saving you money in the long run.

Introduction to Bundling Policies

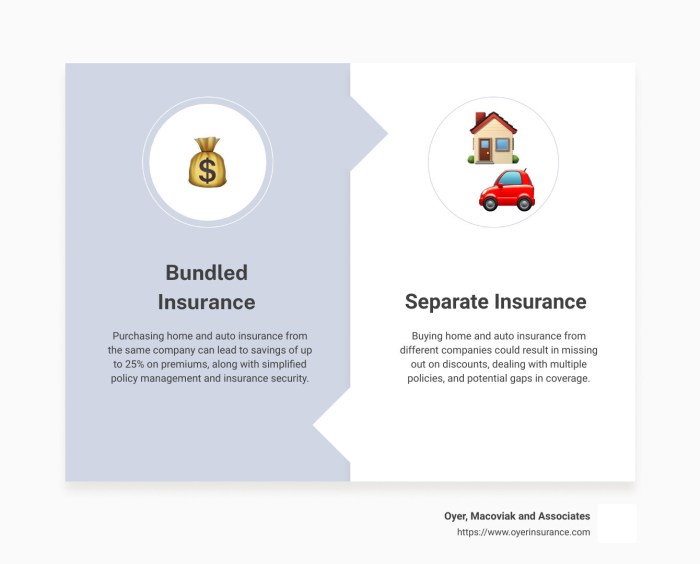

When it comes to auto insurance, bundling policies refers to the practice of purchasing multiple insurance products from the same provider. This commonly includes combining auto insurance with other policies such as home insurance or renters insurance.

One of the key benefits of bundling policies is the potential for significant savings on auto insurance premiums. Insurance companies often offer discounts to customers who choose to bundle multiple policies with them, making it a cost-effective option for many individuals and families.

Benefits of Bundling Policies

- Lower Premiums: By bundling multiple policies, customers can enjoy lower premiums on their auto insurance compared to purchasing individual policies separately.

- Convenience: Managing multiple insurance policies with a single provider can streamline the process and make it easier to keep track of coverage and payments.

- Discounts and Savings: Insurance companies may offer additional discounts or special offers to customers who choose to bundle policies, leading to more savings in the long run.

Examples of Potential Savings

According to a study by the Insurance Information Institute, customers can save an average of 16% on their annual premiums by bundling auto and home insurance policies. This can amount to hundreds of dollars in savings each year, making it a smart financial choice for many households.

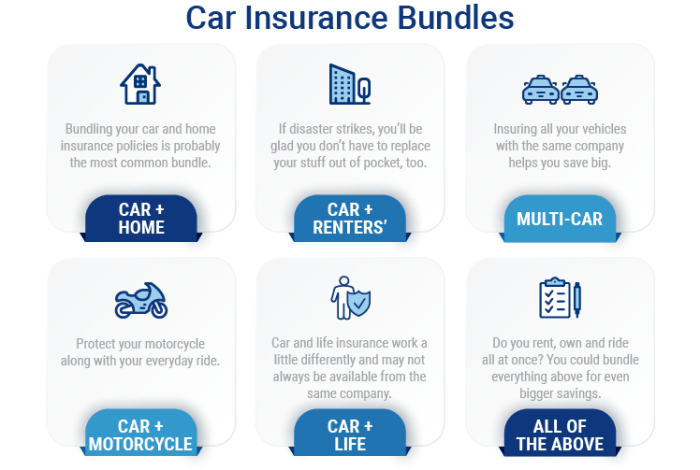

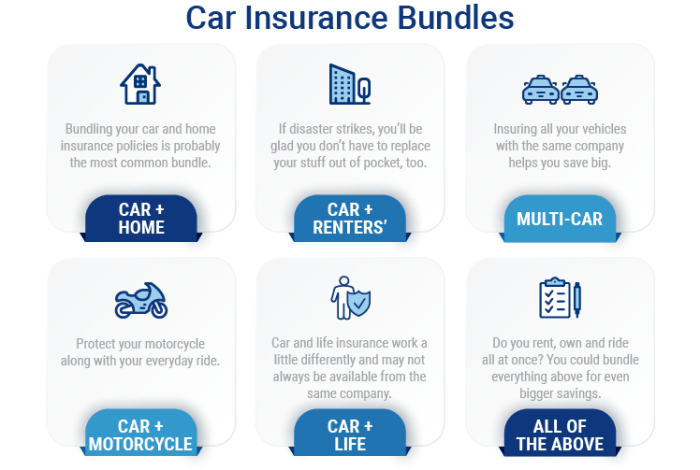

Types of Policies to Bundle

When it comes to bundling insurance policies with your auto insurance, there are several types of policies you can consider. Bundling can often lead to discounts and other benefits, making it a cost-effective option for many individuals.

Homeowners or Renters Insurance

- Bundling your auto insurance with homeowners or renters insurance can often result in a significant discount on both policies.

- Insurance companies may offer a multi-policy discount when you bundle these two types of insurance together.

- For example, you can protect both your home and vehicle with one insurance carrier, simplifying your insurance management and potentially saving you money.

Life Insurance

- Combining your auto insurance with a life insurance policy can also lead to cost savings.

- Some insurance companies offer discounts for customers who have multiple policies with them.

- By bundling your auto and life insurance, you may be able to secure a better rate and streamline your insurance coverage.

Umbrella Insurance

- Umbrella insurance provides additional liability coverage beyond what your auto insurance policy offers.

- By bundling umbrella insurance with your auto insurance, you can enhance your overall protection and potentially receive a discount on both policies.

- This type of policy combination is ideal for individuals looking for comprehensive coverage and cost savings.

Factors to Consider Before Bundling

When it comes to bundling policies to save on auto insurance, there are several key factors to consider before making a decision. Understanding how bundling may impact coverage limits, deductibles, and any potential downsides is crucial in making an informed choice.

Impact on Coverage Limits and Deductibles

One important factor to consider before bundling policies is how it may affect your coverage limits and deductibles. While bundling can often lead to savings on premiums, it's essential to ensure that the coverage levels are sufficient for your needs.

Make sure to review the details of each policy being bundled to understand any changes in coverage limits or deductibles that may occur.

Potential Downsides of Bundling Policies

Despite the potential cost savings, there are also some downsides or limitations to consider when bundling policies. One common concern is that bundling may limit your ability to customize coverage options based on individual needs. Additionally, bundling may result in a lack of flexibility in choosing different insurance providers for each policy, which could impact the quality of service or specific coverage options available.

Tips for Maximizing Savings

When it comes to bundling policies to save on auto insurance, there are several strategies you can implement to maximize your savings. By following these tips, you can potentially secure better deals and discounts from insurance providers.

Negotiating Strategies for Better Bundle Deals

- Research Multiple Providers: Before committing to a bundled policy, research and compare offerings from different insurance providers to ensure you are getting the best deal.

- Bundle Multiple Policies: Consider bundling multiple policies such as auto, home, and life insurance to unlock additional discounts from insurance companies.

- Ask for Discounts: Don't be afraid to ask insurance providers for additional discounts or promotions when bundling policies. Some companies may offer special deals to attract new customers.

- Review Coverage Options: Make sure to carefully review the coverage options included in a bundled policy to ensure they meet your specific needs. Sometimes, a cheaper price may mean sacrificing necessary coverage.

Reviewing and Comparing Bundled Policy Options

- Check for Customization: Look for insurance providers that allow for customization when bundling policies, so you can tailor your coverage to fit your individual requirements.

- Consider Customer Service: In addition to cost savings, consider the quality of customer service provided by the insurance company. A responsive and helpful insurer can make a big difference when filing claims or seeking assistance.

- Assess Long-Term Savings: While immediate savings are important, also consider the long-term benefits of bundling policies. Some insurance companies offer loyalty discounts or rewards for customers who remain with them for an extended period.

Final Review

In conclusion, bundling policies for your auto insurance can be a game-changer in terms of saving money and optimizing your coverage. By considering the types of policies to bundle, key factors to keep in mind, and tips for maximizing your savings, you can make informed decisions that benefit you in the long term.

Start bundling your policies today and reap the rewards of lower premiums and comprehensive coverage.

Question Bank

What is the meaning of bundling policies in auto insurance?

When you bundle policies in auto insurance, it means combining multiple insurance policies, such as auto and home insurance, with the same insurance provider to receive a discount on your premiums.

How can bundling policies affect coverage limits and deductibles?

Bundling policies can sometimes lead to increased coverage limits and lower deductibles as insurance companies offer more favorable terms for policy bundles.

Are there any downsides to bundling policies for auto insurance?

While bundling policies can lead to savings, it's essential to review the coverage details carefully to ensure you are not sacrificing essential coverage for the sake of a discount.