Auto Insurance Deductibles Explained: What You Should Know

Delve into the world of Auto Insurance Deductibles Explained: What You Should Know with this captivating opening that sets the stage for understanding the intricacies of deductibles in the realm of auto insurance.

Continue with detailed information in the subsequent paragraphs to shed light on this essential topic.

Understanding Auto Insurance Deductibles

Auto insurance deductibles are the amount of money you agree to pay out of pocket when you make a claim before your insurance coverage kicks in. Deductibles can vary depending on your policy and are typically set when you purchase your insurance.

How Deductibles Work

For example, if you have a $500 deductible and you get into an accident that causes $2,000 worth of damage to your car, you would pay the $500 deductible, and your insurance would cover the remaining $1,500. On the other hand, if the damage is only $400, you would cover the entire cost out of pocket since it is below your deductible amount.

Relationship Between Deductibles and Premiums

The relationship between deductibles and premiums is inverse. This means that the higher your deductible, the lower your premium is likely to be. If you choose a lower deductible, your premium will be higher because the insurance company is taking on more risk by agreeing to cover a larger portion of the claim.

Types of Auto Insurance Deductibles

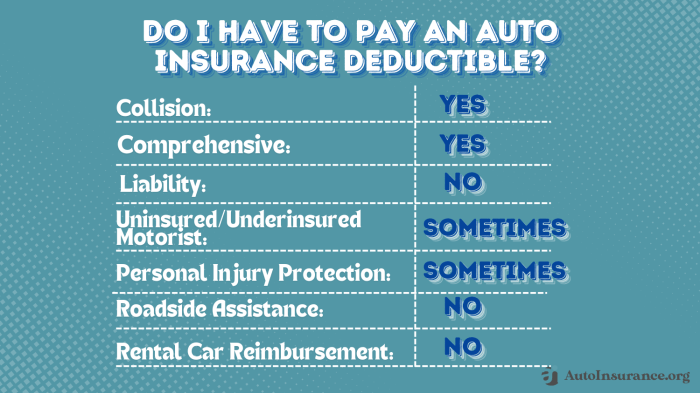

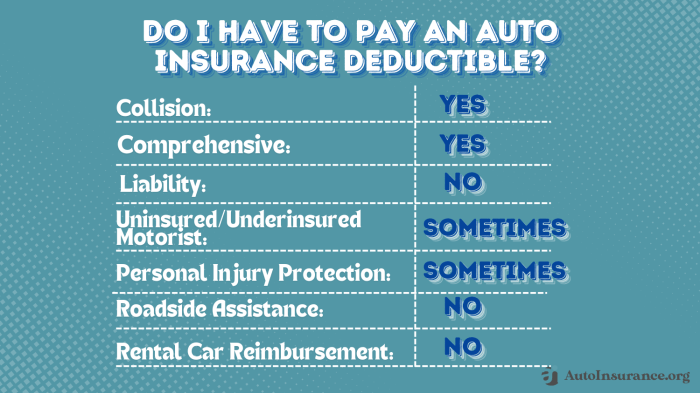

When it comes to auto insurance deductibles, there are different types that can impact your coverage and out-of-pocket expenses in the event of a claim. Understanding these deductible types is crucial in selecting the right insurance plan for your needs.

Collision Deductible

- A collision deductible is the amount you are responsible for paying if your car is damaged in an accident where you are at fault.

- Typically, the higher the deductible amount, the lower your insurance premium will be.

- Pros: Lower premiums, especially if you are a safe driver. Cons: Higher out-of-pocket expenses in case of an accident.

Comprehensive Deductible

- Comprehensive coverage applies to damages caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

- Similar to collision deductibles, higher comprehensive deductibles result in lower premiums.

- Pros: Protection against various non-collision incidents. Cons: Potential high out-of-pocket costs for repairs.

Factors to Consider When Choosing Auto Insurance Deductibles

When deciding on an auto insurance deductible, there are several key factors to consider that can help you make the best choice for your individual needs. Your deductible amount will have a direct impact on your premium costs and out-of-pocket expenses in the event of a claim, so it's important to weigh your options carefully.

Personal Financial Situation

One of the most significant factors to consider when choosing an auto insurance deductible is your personal financial situation. Your ability to cover the out-of-pocket costs associated with a claim will influence the deductible amount you select. If you have a comfortable savings cushion and can afford a higher deductible, you may opt for a lower premium and vice versa.

Driving Habits and Risk Tolerance

Another important consideration is your driving habits and risk tolerance. If you have a history of accidents or live in an area with high traffic or inclement weather, you may want to choose a lower deductible to minimize your financial risk in case of a claim.

On the other hand, if you are a safe driver and rarely file claims, a higher deductible may be more cost-effective.

Type of Vehicle

The type of vehicle you drive can also impact your deductible decision. High-value or luxury vehicles may require a lower deductible to ensure you can cover potential repair costs, while older or less valuable cars may be more suitable for a higher deductible to save on premium costs.

Insurance Premium Costs

Consider how your deductible choice will affect your insurance premium costs. Generally, higher deductibles result in lower premiums, while lower deductibles lead to higher premiums. Evaluate your budget and insurance priorities to strike the right balance between premium savings and out-of-pocket expenses

Tips for Deciding on the Right Deductible

- Assess your financial situation and emergency fund to determine how much you can comfortably afford to pay out-of-pocket in the event of a claim.

- Evaluate your driving history, risk factors, and the value of your vehicle to gauge the likelihood of needing to file a claim and select a deductible that aligns with your risk tolerance.

- Request quotes with different deductible amounts from insurance providers to compare premium costs and potential savings, ensuring you find the best balance for your needs.

- Consider bundling your auto insurance with other policies or exploring discounts that may offset the cost difference between deductible options.

Impact of Auto Insurance Deductibles on Claims

When it comes to auto insurance deductibles, the amount you choose can have a significant impact on how much you receive in a claim. Understanding how deductibles influence claims is essential in making an informed decision when selecting your coverage.

Effect on Claim Payout

- Auto insurance deductibles represent the amount you agree to pay out of pocket before your insurance kicks in to cover the remaining expenses.

- Choosing a higher deductible typically results in lower monthly premiums but also means you'll have to pay more upfront in the event of a claim.

- On the other hand, a lower deductible means higher monthly premiums but less out-of-pocket expenses when filing a claim.

Benefits of Choosing a Higher Deductible

Opting for a higher deductible can be advantageous in certain situations:

- Lower Premiums: Higher deductibles usually translate to lower monthly premium payments, which can save you money in the long run.

- Less Frequent Claims: With a higher deductible, you may be less inclined to make small claims, helping you maintain a lower insurance rate over time.

Examples of Deductible Choices on Claims

Here are a few scenarios illustrating how deductible choices can impact insurance claims:

- Example 1:John opts for a $1,000 deductible on his auto insurance policy. When his car is damaged in an accident with repair costs of $3,000, John will pay the $1,000 deductible, and his insurance will cover the remaining $2,000.

- Example 2:Sarah chooses a $500 deductible. If she faces a similar accident with $3,000 in repair costs, she will only need to pay $500 out of pocket, and her insurance will cover the remaining $2,500.

Closing Notes

Concluding our discussion on Auto Insurance Deductibles Explained: What You Should Know, this summary encapsulates the key points and leaves readers with a profound understanding of deductible nuances in auto insurance.

Question & Answer Hub

What factors influence the choice of deductible amount?

Various factors such as financial situation, risk tolerance, and budget constraints play a role in determining the appropriate deductible amount.

How do deductibles impact the amount paid out in a claim?

Deductibles are the initial amount that policyholders must pay before their insurance kicks in. The higher the deductible, the lower the insurer's payout in a claim.

Are deductible choices reversible?

Deductible choices can be adjusted when renewing policies, allowing policyholders to reassess their needs and make changes accordingly.